By Jenny Holly Hansen | WBN News | May 23, 2025

In the world of commercial insurance, exclusions are clauses that carve out certain risks from coverage. One of the most significant — and often misunderstood — exclusions is the Total Asbestos Exclusion. This clause can have major implications for businesses, especially those involved in construction, manufacturing, property management, or renovation.

What Is the Total Asbestos Exclusion?

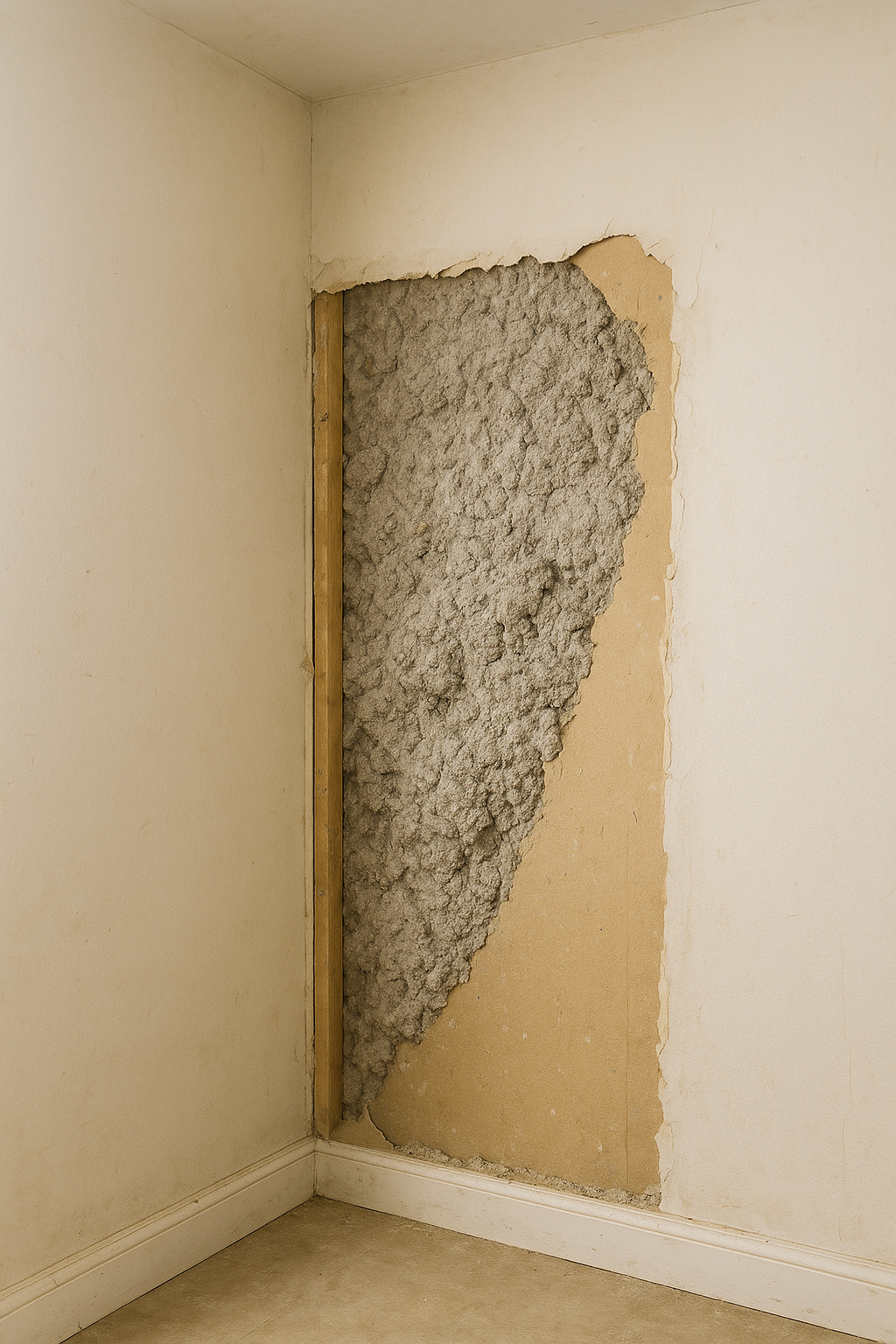

The Total Asbestos Exclusion is a policy clause that completely removes coverage for any liability, loss, or damage related to asbestos. This includes exposure, contamination, cleanup costs, bodily injury, property damage, and legal defense expenses stemming from asbestos-related claims.

Whether it’s asbestos found in insulation, flooring, ceiling tiles, or older construction materials, if the exclusion is present in your policy, your insurer will not respond to any related claims — even if they’re indirect or arise long after work was completed.

Why Do Insurers Include This Exclusion?

Asbestos exposure can result in severe long-term health issues like mesothelioma, lung cancer, and asbestosis. Claims related to asbestos have historically resulted in massive legal and settlement costs for insurers. In response, many providers have adopted strict exclusions to limit exposure to these high-risk claims, especially in policies issued after the mid-1980s when the long-term effects of asbestos became widely acknowledged.

How It Affects Your Business

If your business operates in any capacity that could involve older buildings, construction materials, or industrial facilities, this exclusion can create a serious gap in your risk management strategy.

Here’s how it might affect your operations:

1. Renovation and Demolition Work

If your business renovates, demolishes, or maintains older buildings, you may disturb hidden asbestos. Without coverage, any claims from workers, tenants, or third parties due to exposure will be your responsibility to defend and pay — including legal costs, judgments, and settlements.

2. Property Ownership and Management

If asbestos is discovered on a property you own or manage — even if it was undisturbed — tenants could take legal action claiming negligence or health risk. With the exclusion in place, cleanup and defense costs fall on you.

3. Contractual Obligations

Some clients may require proof of asbestos liability coverage before signing contracts. If your policy contains the exclusion, you may face barriers to securing contracts, especially for work in older infrastructure.

4. Reputation and Operational Delays

Uncovered claims can damage your brand reputation and result in project shutdowns. Even if you manage to defend against them, the distraction and costs can stall growth and eat into your reserves.

What Can You Do?

Understand Your Policy

First, confirm whether your policy includes a Total Asbestos Exclusion. If you work in a field where asbestos exposure is possible, this should be a top priority in your annual review.

Consider Specialized Coverage

If your operations involve asbestos risk, speak with your broker about purchasing environmental liability insurance or contractor’s pollution liability coverage, which may include limited asbestos coverage — subject to terms and underwriting approval.

Stay Compliant with Regulations

Ensure you’re following WorkSafeBC or provincial safety regulations regarding asbestos detection, handling, and removal. Document your compliance and use licensed abatement professionals to reduce risk and demonstrate diligence if claims ever arise.

✅ Update Contracts and Risk Management

Clearly define responsibility for asbestos in contracts and avoid assuming liabilities that your insurance won’t cover. Educate your teams and clients about the risks and procedures around asbestos discovery and handling.

Final Thoughts

The Total Asbestos Exclusion isn’t just fine print — it’s a significant risk consideration. For businesses operating in aging buildings or the construction space, it can mean the difference between an insured claim and a financial catastrophe.

Having the right conversations with your broker — and the right coverage in place — ensures you’re not unknowingly exposed. In an industry where legacy materials meet modern liability, understanding your exclusions is just as important as understanding your coverages.

Let’s Keep Talking:

Jenny is a business insurance broker with Waypoint Insurance. With 19 years experience, she will well versed in the technical aspects of business coverages.

She can be reached at 604-317-6755 or jholly-hansen@wbnn.news. Connect with Jenny on LinkedIn at https://www.linkedin.com/in/jenny-holly-hansen-365b691b/. Connect with Jenny at BlueSky: https://bsky.app/profile/jennyhollyhansen.bsky.social

Let’s Meet Up:

Jenny Holly Hansen is a cohost with Chris Sturges of the Langley Impact Networking Group. You are welcome to join us on Thursday’s from 4pm to 6pm at: Sidebar Bar and Grill: 100b - 20018 83A Avenue, Langley, BC V2Y 3R4

TAGS: #Jenny Holly Hansen #Protect Your Business #Total Asbestos Exclusion #WorkSafeBC