By Miika Makela | WBN News Vancouver | May 27, 2025

Subscribe to WBN News!

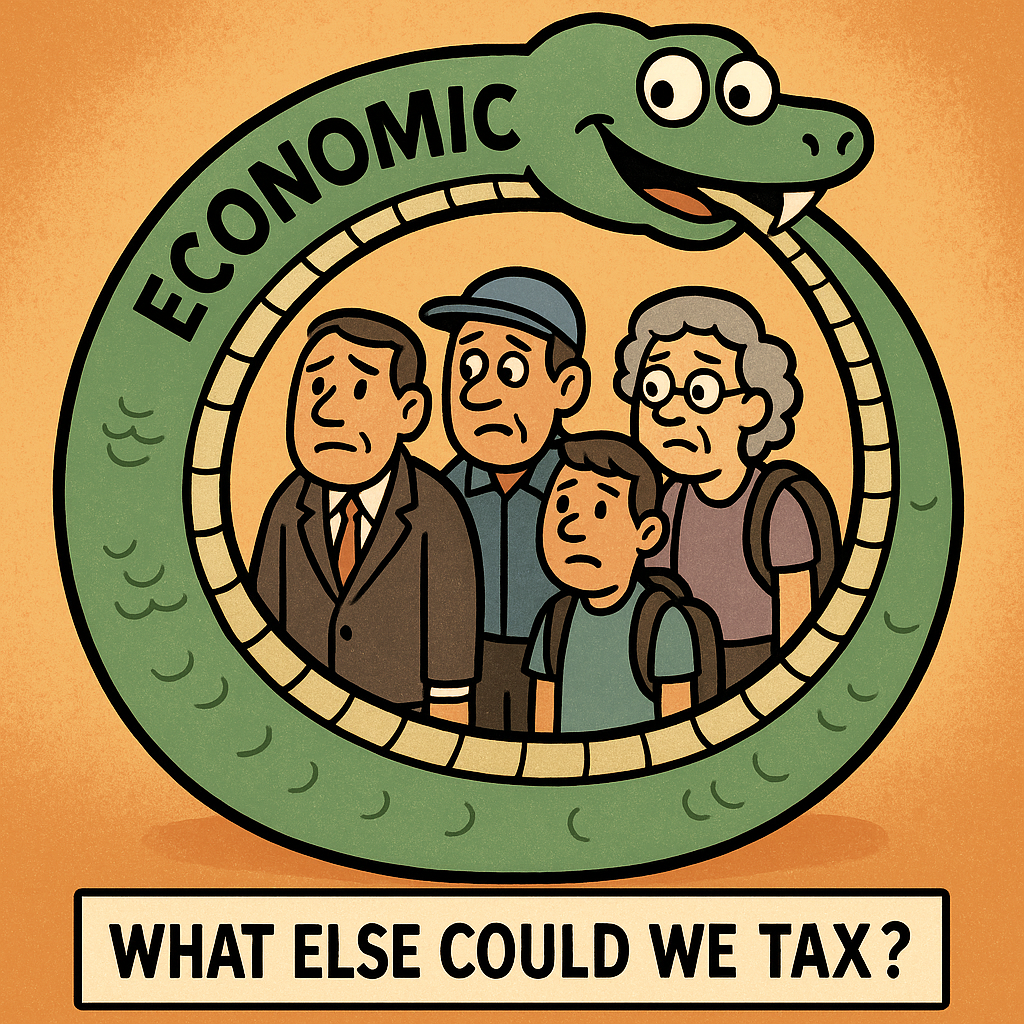

Australia’s proposed tax on unrealized capital gains represents a significant threat to the nation’s private equity sector and, more broadly, to its start-up and innovation ecosystems. By imposing taxes on paper gains—valuation increases that have not been realized through a sale—the government is introducing a policy that fundamentally misaligns with the nature of private market investments. The result is a predictable reduction in venture capital activity and long-term damage to Australia’s economic competitiveness.

Private equity and venture capital investments are typically long-term, high-risk, and illiquid. Start-ups, in particular, depend on this type of patient capital to fund product development, market entry, and growth. These companies are often valued based on future earnings potential, with valuations updated during funding rounds that may occur only every 12 to 24 months. Taxing unrealized gains based on these valuations ignores their inherent volatility and the fact that investors often cannot access or monetize their holdings for many years.

For investors, this policy creates a major disincentive to allocate funds to early-stage businesses. Paying tax on gains that have not been realized—and may never be—is a deterrent to taking on the already significant risks associated with start-up investment. Many investors will likely reduce exposure to private equity entirely or shift capital to more liquid, less penalized assets. The result will be a drying up of crucial early-stage funding across Australia's start-up ecosystem.

This decline in capital availability will have direct consequences. Fewer start-ups will receive the funding they need to grow, hire talent, or commercialize new technologies. Australia’s start-up community, which has been a growing contributor to GDP and high-skilled employment, will face stagnation. The downstream effects could include slower innovation, diminished global competitiveness, and a weakening of Australia’s position in strategic industries such as clean energy, biotech, and advanced technology.

The international implications are just as concerning. Venture capital is global by nature, and investors can deploy funds in any market where conditions are favorable. By taxing unrealized gains, Australia makes itself less competitive relative to jurisdictions like the United States, Singapore, and the United Arab Emirates—countries that have clear, investor-friendly tax policies and robust innovation ecosystems. As a result, capital that might have been allocated to promising Australian start-ups will be redirected elsewhere, depriving the domestic market of the funding it needs to thrive.

Over time, this will also lead to the migration of innovation and talent. As Australian start-ups struggle to raise domestic capital, many will turn to overseas investors who may require relocation to more favorable jurisdictions as a condition of funding. This shift will be accompanied by the departure of founders, engineers, and high-value professionals—a brain drain that will further erode Australia’s innovation capacity.

In sum, the tax on unrealized capital gains is not just a poorly designed fiscal instrument—it is a direct threat to Australia’s private equity markets and to the future of its innovation economy. The expected outcome is a prolonged decline in early-stage investment, reduced competitiveness in global capital markets, and a redirection of innovation activity to more favorable jurisdictions. Over time, this will contribute to a brain drain as talent, technology, and entrepreneurial ambition migrate out of Australia, weakening its long-term economic prospects and global influence.

Miika Makela, CFA

https://www.linkedin.com/in/miika-makela-cfa-24aa056/

#Australia Economy #Venture Capital #Private Equity #Startups #Innovation #Tax Policy #Economic Growth