By Jenny Holly Hansen | Langley News | October 29, 2025

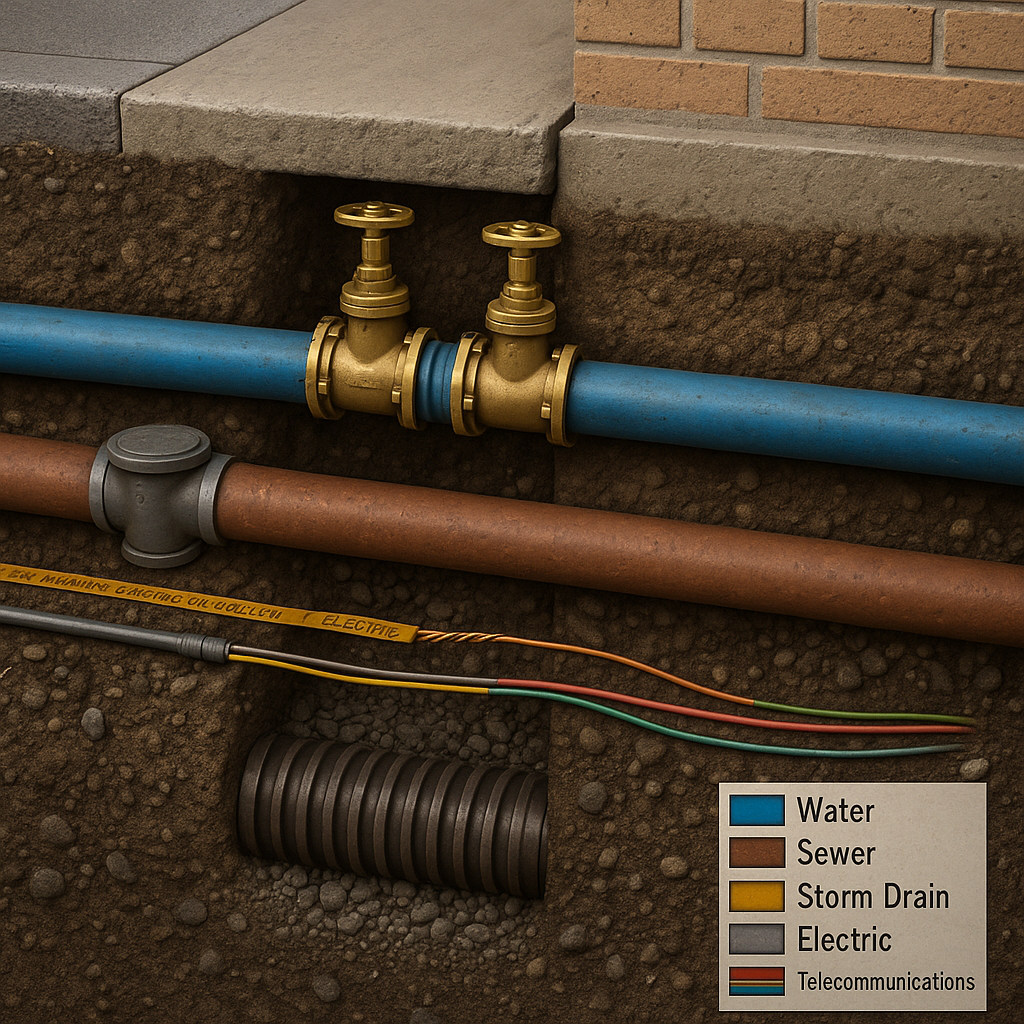

When managing a commercial property, there’s often as much happening below ground as above it. Beneath our feet lies a complex network of electrical lines, water mains, gas pipes, and communication cables that keep modern business running. Yet, many building owners are unaware that these unseen systems come with specific insurance considerations — and potential gaps in coverage — through what’s known as the Underground Cables and Pipes Clause.

What Is the Underground Cables and Pipes Clause?

This clause is a standard part of many commercial property insurance or contractor liability policies. It addresses coverage for damage to underground services such as:

- Water, sewer, and gas pipes

- Electrical or telephone cables

- Fiber-optic communication lines

In simple terms, this clause outlines whether your policy covers accidental damage to underground services — and under what circumstances.

For example, if a contractor on your property accidentally ruptures a buried gas line while excavating for landscaping or drainage, the Underground Cables and Pipes Clause determines who pays for the repairs and any related damages.

Why It Matters to Building Owners

Many property owners assume their insurance automatically covers all aspects of property damage. However, coverage for underground infrastructure is not always automatic — and can sometimes be restricted or excluded entirely.

Typical policies may:

- Cover damage only to services you own, not those owned by a municipality or utility provider.

- Require you to have accurate plans and permits before excavation begins.

- Exclude coverage if damage occurs due to failure to locate or mark services properly.

This means that even a small mistake could lead to a large out-of-pocket expense — not only for repairs, but also for any interruption to neighboring properties or public utilities.

Real-World Example

Imagine you’re renovating your commercial building to add a new parking area. The contractor hits a buried fiber-optic line. The repair costs are $25,000, but the outage affects local businesses, leading to third-party claims totaling another $100,000.

If your insurance policy’s Underground Cables and Pipes Clause excludes this type of damage, you — or your contractor — could be held financially responsible.

How to Protect Yourself and Your Business

Here are a few steps every building owner should take to reduce their risk and ensure proper protection:

- Review Your Policy Carefully

Check whether your policy includes underground services coverage. Ask your insurance advisor to explain what’s included, what’s excluded, and what documentation might be required. - Require Contractors to Carry Proper Coverage

When hiring contractors for any work that involves digging or drilling, ensure their Commercial General Liability (CGL) policy includes coverage for underground utilities. Request a certificate of insurance before work begins. - Get and Keep Utility Locates

Always call your local utility locator service (e.g., BC 1 Call) before any ground disturbance. Keep the locate reports and site maps on file — insurers often require proof that locates were completed. - Consider Adding Endorsements

If your business depends on underground systems (for example, data centers, manufacturing plants, or multi-unit buildings), you may want to add an endorsement to extend coverage beyond the standard clause. - Work With a Knowledgeable Broker

Understanding policy language and exclusions can be complex. A broker who specializes in business or property insurance can help you identify potential gaps and recommend appropriate coverage.

Final Thoughts

The Underground Cables and Pipes Clause might seem like fine print, but it can have major implications for building owners. In a world where downtime and repair costs can escalate quickly, ensuring your business insurance addresses underground risks is more than just prudent — it’s essential.

A quick policy review today could save you from a costly surprise tomorrow.

Let’s Keep Talking:

Jenny is a business insurance broker with Waypoint Insurance. With 19 years experience, she will well versed in the technical aspects of business coverages.

She can be reached at 604-3177 or jhansen@waypoint.ca

Connect with Jenny on LinkedIn at https://www.linkedin.com/in/jenny-holly-hansen-365b691b/.

TAGS: #Jenny Holly Hansen #Underground Cables and Pipes Clause #Protect Your Business