✍️ By Debbie Balfour | WBN News | January 9, 2026 | Click HERE for your FREE Subscription to WBN News and/or to be a Contributor.

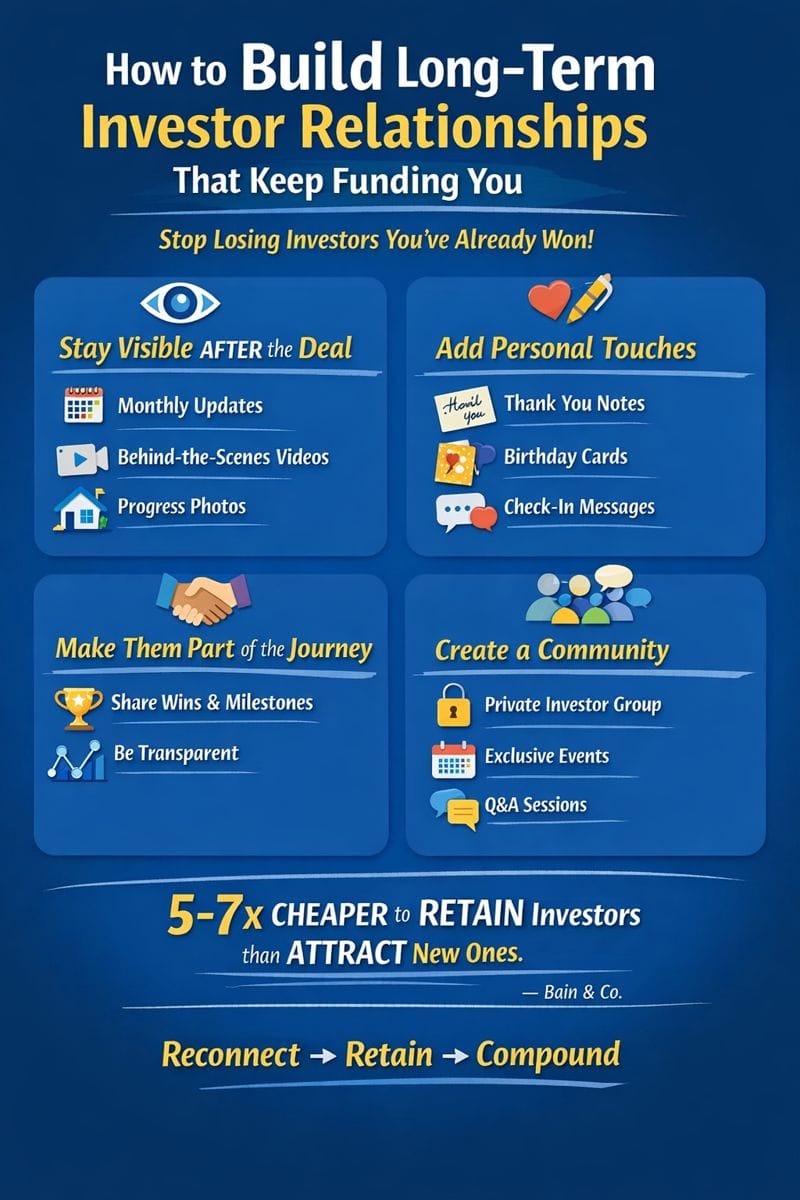

Would you rather chase new investors on every deal, or have your current ones lining up for the next opportunity before you even ask? That question separates the hobbyists from the real business builders. The truth is, the difference between financial freedom and burnout isn’t about finding more investors; it’s about keeping the right ones coming back.

Most investors make the same costly mistake: communication stops the moment the deal closes. No updates, no thank-yous, no sense of belonging. And just like that, the trust you worked so hard to earn quietly fades away. You end up pitching like it’s Shark Tank all over again, chasing new investors instead of nurturing the ones who already believed in you.

But it doesn’t have to be this way.

Smart real estate entrepreneurs know that building long-term investor relationships is the true secret to scaling. It’s about making investors feel seen, valued, and included long after their check clears. Here’s how you do it.

1. Stay Visible Even After the Deal

Send monthly updates: even a quick video, newsletter, or photo of progress goes a long way. Investors don’t need perfection; they crave connection. Keep them in the loop, and they’ll stay emotionally invested.

2. Add Personal Touches

Handwritten notes, birthday cards, and “just checking in” messages show appreciation. These simple gestures transform a one-time investor into a loyal partner. Remember, they’re not just investing in properties; they’re investing in you.

3. Involve Them in Your Wins

Finished a renovation early? Hit a rental milestone? Celebrate it with them. Show them how their trust made an impact. Transparency builds trust, and trust builds repeat funding.

4. Build a Community

Create a private group, host a coffee chat, or start an investor newsletter. People want to belong to something bigger than a balance sheet. Give them connection, and they’ll give you loyalty.

According to Bain & Company, it costs 5–7 times more to find a new client than to keep an existing one. The same rule applies here. Retention creates momentum. Repeat capital compounds.

In my own journey, I learned that relationships outlast any deal. When I lost my home and job, my investors stood by me because I’d nurtured those relationships with authenticity and transparency.

So here’s your challenge this week: reach out to one past investor. A call, a note, a thank-you message. Start rebuilding that bridge because your next million-dollar opportunity might already be sitting in your inbox.

Debbie Balfour | Real Estate Investing Success Coach + Podcast Host

📍 Website: www.DebbieBalfour.com

📧 Email: Debbie@DebbieBalfour.com

🔗 LinkedIn: Debbie Balfour

▶️ YouTube Channel: youtube.com/@DebbieBalfour

Join the FREE Facebook Group: Real Estate Investor Success Hub

Download your FREE 5 Fastest Ways to Fund Your Next Investment Project guide.

TAGS: #Real Estate Investing #Investor Relations #Wealth Building #Passive Income #Real Estate Growth #WBN News Langley #WBN News Abbotsford #WBN News Okanagan #Debbie Balfour